BMO Business Banking

Make real financial progress today

Accept card payments from your customers

For a limited time, open a new Merchant Services account and get up to a $600 statement credit.

Business tips and insights

We’re here to help your business succeed at every stage. Access business tools, workbooks, videos and more.

Business Platinum Rewards Credit Card

Earn a welcome bonus up to 100,000 points, optimize cash flow and track expenses.

Streamline your billing process

BMO Bill Connect helps you manage your accounts in a simple, faster and more secure way.

Zero Barriers to Business

We’re committed to helping minority-owned businesses gain better access to lending options, education and partnership opportunities.

Ready to get started?

Select your annual revenue to find the best way to get personalized help.

Ready to get started?

Select your annual revenue to find the best way to get personalized help.

Explore our most popular products

We’re here to help you make real financial progress and see your business thrive.

Contact a business banker

We’ll be in touch within one business day.

Find a commercial banker

Tell us more about what you need and we’ll match you to the right commercial banker.

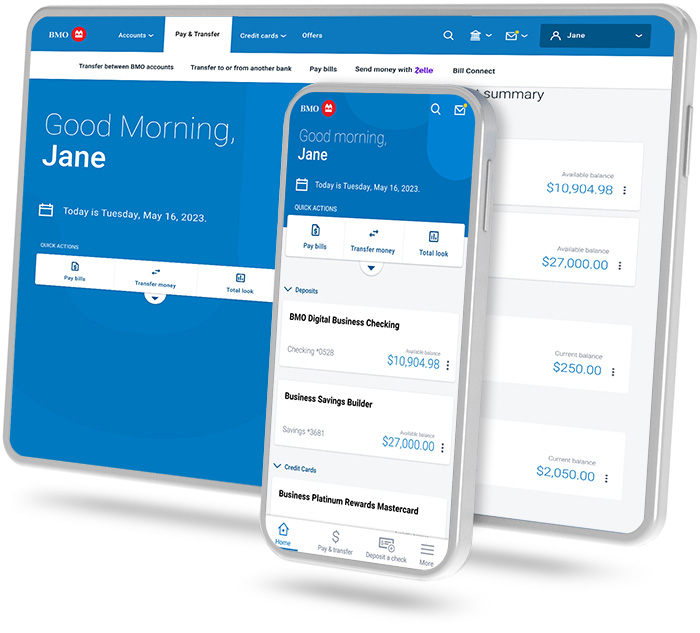

Bank anywhere with the BMO digital banking app

Special features such as Zelle®, Bill Connect and more to help business owners manage their money safely, quickly and easily.

Take the next step toward better business banking

Let's chat

Call us at 1-888-340-2265 or schedule a time to chat.

Join our email list

Business resources, top tips and advice delivered straight to your inbox.

Visit us

Meet with a BMO Banker on your schedule.