BMO Business Banking

Make real financial progress today

Accept card payments from your customers

For a limited time, open a new Merchant Services account and get up to a $750 statement credit.

Business tips and insights

We’re here to help your business succeed at every stage. Access business tools, workbooks, videos and more.

Business Platinum Rewards Credit Card

Earn a welcome bonus up to 100,000 points, optimize cash flow and track expenses.

Streamline your billing process

BMO Bill Connect helps you manage your accounts in a simple, faster and more secure way.

Zero Barriers to Business

We’re committed to helping minority-owned businesses gain better access to lending options, education and partnership opportunities.

Explore business checking accounts

Find an account that’s tailored to your needs, whether your company is new, growing or established.

Open a business savings account

Explore your options and see why our savings accounts are designed to help your business grow.

The benefits of a business bank account

Learn more about business bank accounts – including the best time to open one and how to get started.

Explore BMO Credit Cards

Get even more from your business-related expenses with the right credit card.

Business Platinum Rewards Credit Card

Earn a welcome bonus up to 100,000 points, optimize cash flow and track expenses.

Manage your cards online

Make payments, review transactions and more by registering for Business Credit Card Online Access.

6 tips to build business credit

Strong business credit may help your company get a credit card, loan and line of credit.

Accept card payments anytime, anywhere

Boost your business with powerful point-of-sale systems offered by Elavon.

Business Platinum Credit Card

Easily manage your business finances with a low intro APR on purchases and balance transfers.

Save $150 on a new line of credit*

Cover expenses, purchase inventory, invest in equipment or expand into new markets.

Business lending & loans

A growing business needs access to funds to stay competitive and realize its full potential.

Business loan calculator

To get a better idea of what your business payments could be, try using our calculator.

Government loan programs (SBA)

Explore a variety of SBA loan programs to support your business needs.

How to get a business loan

We broke down the process of getting a business loan into 5 easy steps.

Zero Barriers to Business

We’re committed to helping minority-owned businesses gain better access to lending options, education and partnership opportunities.

Zero Barriers to Business

We’re committed to helping business owners gain better access to lending options, education and partnerships.

BMO for Native-owned businesses

We provide access to funding, networking opportunities and more.

Arty’s Sweet Talk Cupcakes

Artaynia Westfall tells her story, and how receiving a BMO grant helped her business soar.

How to prepare a business plan

By taking the time to create a solid plan, you’ll be in a position to better understand your market and competition.

Business tips and insights

We’re here to help your business succeed at every stage. Access business tools, workbooks, videos and more.

Introducing the Thrivefecta podcast

Our limited series features 10 dynamic women who are thriving in their careers, finances and personal lives.

How to manage a business cash flow crisis

Every business goes through a cash flow problem – be prepared with actionable tips to get ahead.

Increase your sales in 90 days

A quick boost in sales is achievable providing you plan properly, set clear targets and more.

How to prepare a business plan

By taking the time to create a solid plan, you’ll be in a position to better understand your market and competition.

How to find more customers and alternative suppliers

Keep your business thriving with these tips to add customers and find back-up suppliers.

Business tips and insights

We’re here to help your business succeed at every stage. Access business tools, workbooks, videos and more.

How to get a business loan

We broke down the process of getting a business loan into 5 easy steps.

Ready to get started?

Select your annual revenue to find the best way to get personalized help.

Ready to get started?

Select your annual revenue to find the best way to get personalized help.

Explore our most popular products

We’re here to help you make real financial progress and see your business thrive.

Contact a business banker

We’ll be in touch within one business day.

Find a commercial banker

Tell us more about what you need and we’ll match you to the right commercial banker.

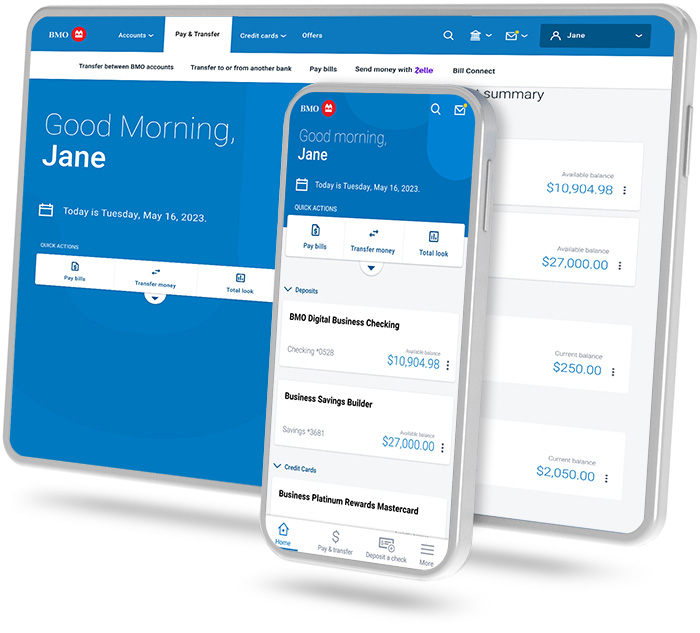

Bank anywhere with the BMO digital banking app

Special features such as Zelle®, Bill Connect and more to help business owners manage their money safely, quickly and easily.

Take the next step toward better business banking

Let's chat

Call us at 1-888-340-2265 or schedule a time to chat.

Join our email list

Business resources, top tips and advice delivered straight to your inbox.

Visit us

Meet with a BMO Banker on your schedule.