BMO Personal Banking

What can we help you find today?

Special Offers

From everyday banking to credit cards, find ways to save money and make real financial progress.

New Financial Progress Hub

Access our financial resource hub to help you manage your money and plan for your future.

Explore our checking accounts

We have a checking account to help you achieve your financial goals.

Security alerts: Learn what to look for

Identify and learn how you can protect yourself against the different types of fraud.

Let's talk spending in relationships

Couples are more likely to argue about spending habits. Explore how couples communicate about finances.

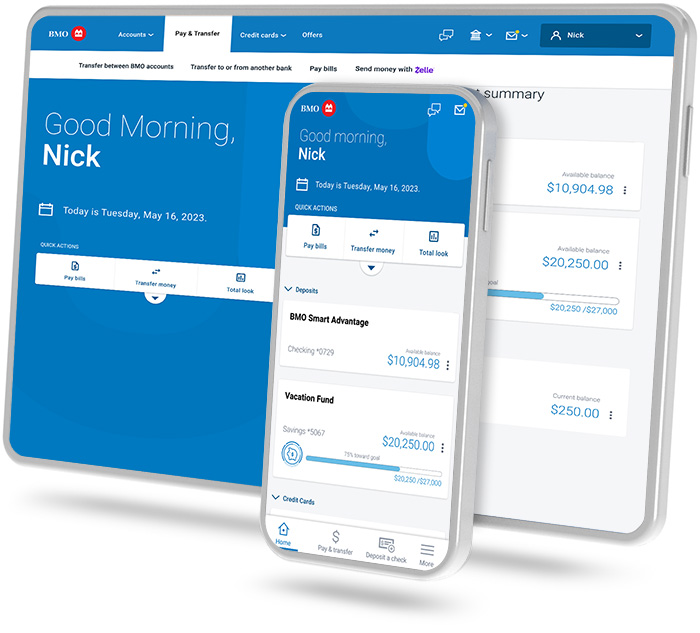

Bank anywhere with BMO Digital Banking

Bank on-the-go anywhere, anytime with our app. Enjoy 20+ features that help you make real financial progress.

Need support? That’s what we’re here for

BMO online support

Get the support you need using our tool

Visit us

Find the nearest BMO branch to you