BMO Personal Banking

What can we help you find today?

Special Offers

From everyday banking to credit cards, find ways to save money and make real financial progress.

New Financial Progress Hub

Access our financial resource hub to help you manage your money and plan for your future.

Explore our checking accounts

We have a checking account to help you achieve your financial goals.

Security alerts: Learn what to look for

Identify and learn how you can protect yourself against the different types of fraud.

Let's talk spending in relationships

Couples are more likely to argue about spending habits. Explore how couples communicate about finances.

BMO Smart Advantage Checking

Make your money go farther with our most popular checking account.

Explore our checking accounts

We have a checking account to help you achieve your financial goals.

Switch to BMO in 3 easy steps

We’ve prepared a switch kit to make switching banks even easier for you.

Should I open a CD or money market account?

Both are steady methods to help you grow your money.

How to start an emergency fund

Life can be unpredictable – it’s important to build your savings for those “just-in-case" moments.

Money market offer bundle

Earn an even higher interest rate by bundling a money market with a Relationship Checking Account.

BMO Cash Back Credit Card

Earn cash back on your everyday purchases such as groceries, gas and TV streaming services.

Explore our credit cards

We have a credit card to bring you the best perks and match your lifestyle.

How does a balance transfer work?

Understand the pros and cons of submitting a balance transfer.

Need to activate your credit card?

Learn how to activate your card and manage it on the go.

Your rewards. Your way.

Visit bmoflexrewards.com to explore your redemption options.

Get a low rate on a HELOC

Make the most of the equity in your home with a home equity line of credit (HELOC).

Explore our loan options

Whether you need to purchase a new car, buy a home, or cover a large expense, we can help you get there.

Loan calculators

Answer all of your lending questions with the help of our calculators.

Everything you need to know about fixed vs. adjustable rate mortgages

Find out what the difference is and which one is right for you.

HELOC or HELOAN?

Find out whether a home equity line of credit (HELOC) or home equity loan (HELOAN) is right for you.

Mortgage special offers

Learn how you can save on mortgage costs with our special limited-time offers.

Invest with BMO

Whether you need help with financial planning or you’re saving for retirement, we’re here to help.

Investment calculators

Use our handy calculators to help plan for an investment or for your retirement.

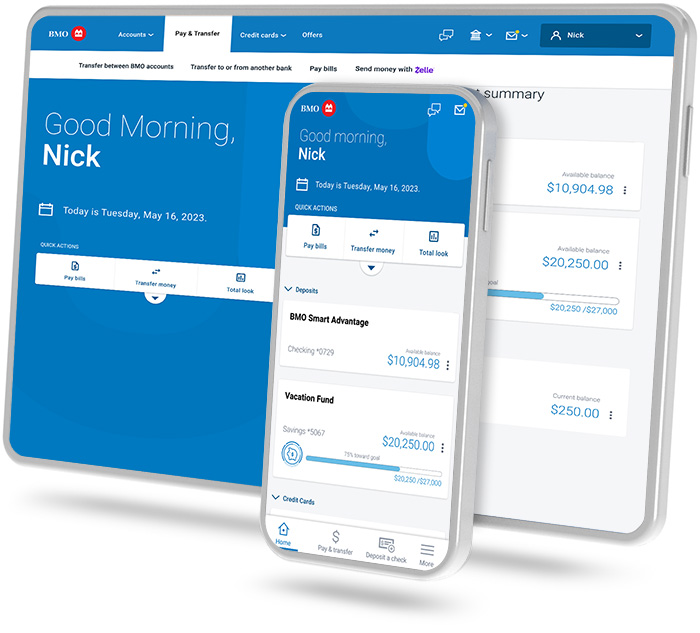

BMO Digital Banking

Enjoy features like BMO Total Look to track and manage your finances and Zelle®, an easy way to send and request money.

Financial Progress Hub

Access our financial resource hub to help you manage your money and plan for your future.

10 financial goals to set for yourself

Thinking about how you can rock your goals? Don’t forget your financial ones too!

Should I open a CD or money market account?

Both are steady methods to help you grow your money.

What's a HELOC?

A home equity line of credit (HELOC) can help you access funds for major purchases such as a home renovation.

What is a credit score?

Get a better understanding of the factors influencing your score and helpful tips to improve your rating.

Bank anywhere with BMO Digital Banking

Bank on-the-go anywhere, anytime with our app. Enjoy 20+ features that help you make real financial progress.

Need support? That’s what we’re here for

BMO online support

Get the support you need using our tool

Visit us

Find the nearest BMO branch to you