What is a cash back credit card and how to get the most value?

Cash back on credit cards reward you with a percentage of your card purchases back. Learn how they work, and how to can get the most out of your cash back card.

Credit card rewards programs allow you to get back some of what you spend in the form of points, miles or cash back. That's a good incentive to use credit vs. debit when making a purchase or payment, but to get the best value out of your rewards program, it's important to choose a credit card that matches your spending style and habits.

Cash back credit cards can save you money on purchases if you're redeeming cash rewards as a statement credit. However, that's not the only way you can put cash back rewards to work.

Understanding how cash back credit cards work can make it easier to choose the right card that fits your lifestyle.

What is a cash back credit card?

A cash back credit card is a rewards card that pays you back a percentage of what you spend. It may come in the form of cash or points that can then be converted to cash, which can be used to pay down your credit card balance. The percentage of cash back you earn can vary from one card to another.

Cash back credit cards tend to shape their rewards programs around everyday spending categories. For example, you’ll commonly find cash back credit cards that pay you a percentage back when you use them to buy groceries, fuel up your vehicle or shop online.

Here’s what you need to know about how cash back credit cards work.

How do cash back credit cards work?

Cash back credit cards work by assigning a set rewards value to each dollar that you spend. For example, you might earn 2% back for each dollar spent; so, for every $100 in purchases, you’d collect $2 in rewards.

Some of the main things that can distinguish one cash back credit card from another include:

- Which purchases earn cash back

- Rewards rates, or how much cash back you earn (i.e., 1% per $1 spent)

- When cash back is credited to your account

- How much cash back you need to earn before you can redeem rewards

- What you can redeem cash back for and how often redemptions are allowed

It's important to note that only purchases typically earn cash back. Credit card companies usually don't pay you cash back rewards for other transactions, such as balance transfers or cash advances.

The cash back you earn accumulates in your account as you spend, and it may take one to two statement cycles for it to be credited to your credit card rewards balance. While less common, there are cash back rewards credit cards that only issue rewards certificates once a year.

How to earn cash back with your credit card

The way that you earn cash back with your rewards credit card will depend largely on how the program is structured. There are three primary ways that you can earn cash back with a credit card:

- Flat rate

- Tiered rewards

- Rotating rewards

A flat-rate rewards credit card pays you the same amount of cash back on every eligible purchase. For example, you might have a card that pays unlimited 2% cash back on everything — whether you're charging groceries, gas or even travel to your card. This means that, for every $100 you spend with your card, you're getting $2 in cash back rewards.

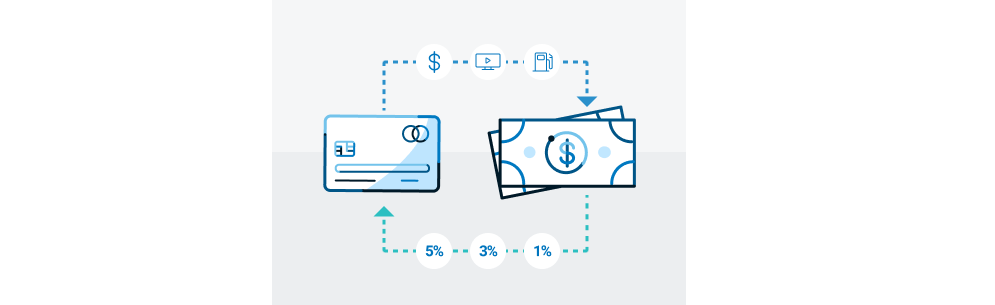

Cash back credit cards that tier rewards pay a higher percentage for purchases in popular select spending categories. For example, the BMO Cash Back Mastercard® offers:

- 5% cash back on eligible streaming, cable TV and satellite services

- 3% cash back on eligible gas and grocery purchases (up to $2,500 in purchases per quarter)

- 1% cash back on all other eligible purchases

To learn more about this card, calculate your cash back potential.

Other credit cards rotate rewards throughout the year, with different spending categories earning a higher rewards rate at different times.

For example, you might earn 5% back on gas and groceries in the first quarter, up to the first $1,500 in purchases. Once you hit the $1,500 threshold, you'd continue earning 1% cash back on those purchases while also earning unlimited 1% cash back on everything else.

When the second quarter begins, you might earn 5% back on dining or online shopping instead. The pattern repeats itself, with different spending categories earning 5% back in the third and fourth quarters respectively.

A handful of cash back credit cards take a slightly different approach by either assigning the highest rewards rate to your highest-spending category each month, or allowing you to choose in which spending categories you’d prefer to earn the most cash back. That kind of rewards structure might appeal to you if your spending habits fluctuate from month to month.

How to calculate the value of your cash back rewards

Knowing how you can earn cash back rewards can help you estimate the amount of cash back you might accumulate monthly or year.

Using the BMO Cash Back Mastercard® as an example, let’s assume that you spend $100 per month on streaming services, $800 per month on gas and groceries and $500 per month in miscellaneous/other purchases. Here's how your monthly cash back earnings would break down with this card:

- $100 x 5% = $5

- $800 x 3% = $24

- $500 x 1% = $5

That's $34 per month — or $408 per year — in cash back credit card rewards that you could earn on your everyday spending.

What if you have a cash back rewards credit card that applies the quarterly rotating bonus category approach?

Assume that you max out the $1,500 bonus category that earns 5% back. That's $75 in cash back earned. You then charge an additional $1,500 in purchases that earn 1% cash back. Your total cash back for the quarter adds up to $90. Do that all year long and you'd earn $360 in cash rewards.

Calculating your estimated cash back value can help you to determine which type of card is likely to be the most rewarding. Also, note that if you choose a credit card that offers a quarterly bonus, you may be required to opt-in before you can begin earning the higher cash back rewards rate.

What are the advantages of having a cash back credit card?

Cash back credit cards can offer a number of benefits to cardholders. Here are some of the best reasons to consider regularly using a credit card that offers cash back:

- Easy to use. Cash back credit cards are fairly straightforward. When comparing cards, the main things you need to know are how you earn rewards and how you redeem them.

- Constant rewards value. A cash back credit card may not pay the same rewards rate on all purchases, but they typically do pay rewards on everything you buy. So, even if you're only getting 1% cash back on a purchase, you're still getting something back.

- Low or no annual fees. Credit card annual fees can eat into the rewards you're earning, but the benefits typically outweigh the fee. Plus, there are plenty of no-fee and low-fee cash back card options to consider.

- Added features and benefits. While cash back might be the focal point of a rewards credit card, they can offer other features and benefits. For example, you might be able to qualify for an introductory cash back bonus, get extended warranty protection for purchases or even receive Cell Phone Protection as a built-in benefit. BMO is one of many issuers that offer these as card benefits.

A cash back credit card can also help you to build a good credit history if you're paying your bill on time. Even if you occasionally make a few larger purchases, keeping your overall balance low over time can help build credit.

How do you redeem cash back rewards?

Your options for redeeming cash back can depend on which credit card you have. For example, BMO credit cardholders who earn cash back can choose from the following redemption options:

- Statement credit

- Cash/direct deposit into a BMO checking, savings or money market account

- Pay Me Back, which allows you to apply rewards against past purchases

Other credit cards might allow you to redeem cash back for travel, gift cards, shopping or even charitable donations.

You may need to earn a certain amount of cash back before you can redeem it. For instance, it’s not uncommon for card issuers to require you to hit a $25 threshold before you can redeem rewards.

There’s a $15 minimum rewards balance to redeem cash back earned with the BMO Cash Back credit card. You can choose when to redeem your rewards, though other credit card issuers may allow you to opt-in to automatic redemption. With that option, rewards are automatically applied as a statement credit.

What’s the difference between credit card rewards programs?

There’s a lot to like about cash back credit cards, but they aren’t your only option for earning rewards. There are also credit cards that offer points or miles in lieu of cash when making purchases.

For example, you might have a travel miles credit card that pays unlimited double miles on everything you spend. You could then redeem those miles toward airfare, hotels or other travel expenses on a future trip.

Or, you might have a card that pays you a set number of points on purchases. So, you might earn 3 points per $1 spent on dining and entertainment, 2 points per $1 spent on gas and 1 point per $1 spent on everything else you charge to the credit card. You could then redeem those points for travel, gift cards, statement credits or shopping. The BMO Premium Rewards Mastercard uses a similar approach.

All three credit card options — cash back, points and miles — are technically classified as rewards credit cards. The main difference between these is the type of rewards you’re earning when you spend.

How do you choose a credit card?

Choosing a credit card starts with understanding your spending style, which can help you narrow down which type of card is best suited for your needs.

For example, if you spend the most money each month on groceries and gas, then a cash back card could be the best option. On the other hand, if you primarily use a credit card to book travel while using your debit card for everything else, you might want to consider one that offers travel miles or points.

Once you know what kind of rewards card you need, you can compare details like the rewards structure, annual fee, annual percentage rate (APR) and benefits. If you're ready to find the right card, explore your options with BMO today.

Looking for the right BMO card?

Let us help you find the perfect credit card for you.